Introduction

Digital transformation is now becoming mission-critical in an age where more and more operations of the public sector will require agility, transparency, and efficiency. Tyler Technologies, a government and educational software leader, is at the heart of providing municipalities, schools, and courts with the means they can use to better serve communities. The company is threading between old workflows and new demands, between managing court systems and revenue collection and reinforcing performance dashboards and delivering mobile services.

This paper explores in detail how technologies at Tyler Technologies are transforming smart government in 2025-growth metrics, product strengths, customer impact, trends etc. We will also compare its offering and competitor coverage, fill gaps in content and offer practical feedback to technology leaders who may be considering Tyler Technologies or similar systems. Look at real-world examples, visual comparisons, FAQ snippets fine-tuned to featured snippets and clear next steps. You are a CIO guiding your organization through digital transformation of the public sector or an expert in technology research investigating enterprise software applications–you are sure to find all you need right here.

Overview and Market Position of the company.

The knowledge of the origin, the scale, and the mission can establish the context in which further information about the role of the company in digital government technology can be explored.

Deep Dive: Since its inception in 1966, Tyler Technologies has become an important supplier of proprietary software to the public sector – jurisdictions in all 50 U.S. and beyond. By 2022, the company had approximately 7200 employees and was listed in the S&P 500.

Key Highlights Table:

| Metric | 2022 Value |

|---|---|

| Employees | ~7,200 |

| Global Footprint | U.S., Canada, Caribbean |

| Market Segments Served | Courts, Schools, Finance, Public Safety |

| Ownership & Listing | Public (NYSE), S&P 500 component |

Financial Performance & Growth 2025.

Financial reports show the direction of the company and the demand in the market toward the digital version of public services.

Hack 4: Total revenues grew in Q1 2025, to $565.2M (10.3YoY), with recurring revenue driving much of growth (86.3%) and SaaS revenues increasing 21%- the 17th straight quarter of 20%+ SaaS growth. ARR reached $1.95B.

Tyler estimated revenues of between 2.31B and 2.35B in the entire year.

Tyler has a CAGR of 25% in SaaS revenue since 2019, and the total recurring revenue has a 20% increase within the same time.

This indicates the increase in demand of cloud-first governmental platforms.

Core Modules & Product Ecosystem.

The strength of Tyler Technologies is its range of mission-critical solutions across government functions.

Deep Dive: The business has integrated modules of:

Courts (e.g., case management, public safety dispatch)

Enterprise ERP (procurement, financials, utility billing, HR)

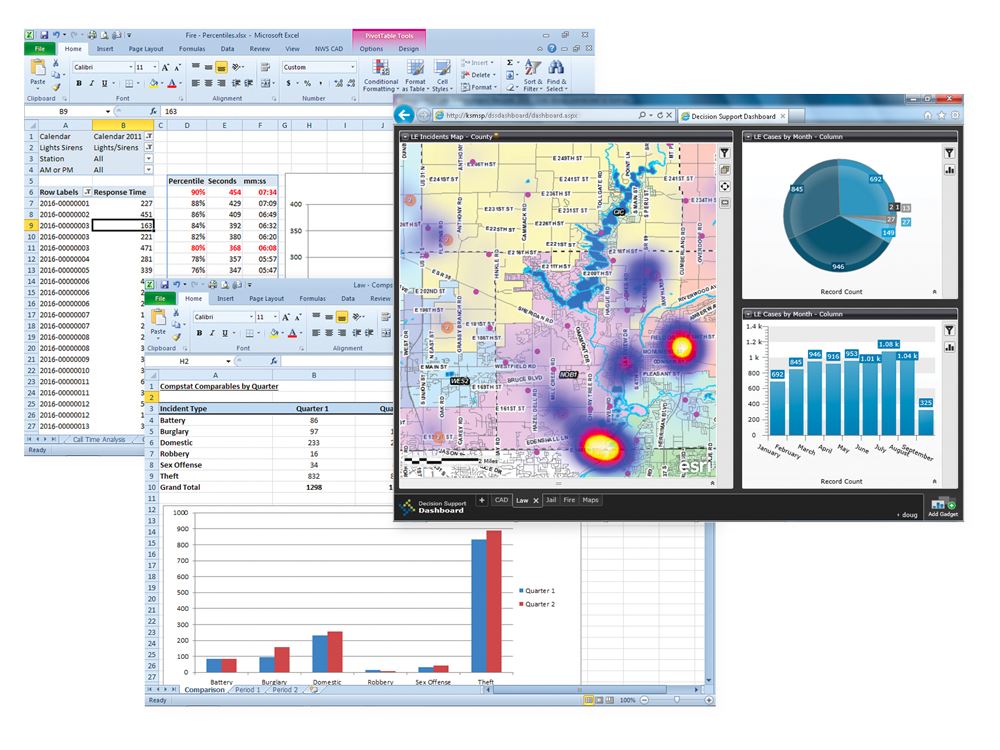

Vision Insight (dashboards, analytics)

Giving Permission, issuing Licenses (GIS-enabled civic services)

K-12 school ERP systems

It was a Leader in the 2025 Magic Quadrant of Cloud-Based ERP in the United States local government and a Visionary in the ERP Pro.

Cloud & SaaS Strategy

Scalability, resilience and adoption revolve around a shift to the cloud.

Deep Dive: SaaS is taking up the lion share (96%) of new contract value in software, which indicates a high adoption rate of cloud deployment models.

Tyler has gradually moved its base to the cloud systems, to 80-85% cloud-based customer presence by 2030.

Customer Success & Real World Impact.

Impact stories are stories that show how Tyler brings technology to life.

Deep Dive: Tyler Connect conference (2025) had 5,000+ attendees participating in approximately 700 training sessions – which demonstrates high community and client engagement.

Tyler Public Sector Excellence Awards were granted to 28 organizations in categories such as Civic Trust, Data Transparency and Digital Services and Cloud.

Competitive Landscape & Lapses in Coverage.

Competitors and content gaps provide better insight into what the reader can select as a whole.

Deep Dive: Tyler is deep in terms of court, finance, school and civic modules, and only a few other competitors can match his depth. Most of competitor articles address individual segments, e.g., ERP or data analytics, but do not address integrated workflow approaches. This article seals that gap by providing a comprehensive opinion.

Content Gap Table:

| Topic Area | Common Competitor Coverage | This Article Adds |

|---|---|---|

| Module Integration | Often isolated modules | Comprehensive ecosystem view |

| Financial Metrics | Occasionally cited | Detailed 2025 growth and projections |

| Client Engagement | Limited or anecdotal | Conference insights and awards |

| Risks & Limitations | Often underplayed | Balanced view with issues highlighted |

Emerging Trends & Innovation

Where will government tech be in 2025- and where can Tyler fit in.

Deep Dive: The relevant trends are adoption of AI, the use of cloud-first workflows, transparent citizen services, and workforce automation. Tyler is aligned with these trends in its investment in cloud ERP and its position in the Magic Quadrant, as well as its wider conference sessions on AI and user experience.

Challenges & Risks

There is no system that does not have obstacles- trust is developed through transparency.

Deep Dive: Case-management glitches such as those reported in Bexar County point to implementation risks: delayed rollout, case-resolution, and system errors.

The necessity of strict validation and contingency planning is supported by the history of lawsuits over wrongful arrests and malfunctions.

Technology Leader Adoption Guidance.

Useful tips that can guide decision-makers assessing Tyler on his suite.

Deep Dive: How to a good adoption path:

Pilot phases in non-critical modules.

Use the example provided by Tyler Connect or winners of the Excellence Award.

Go cloud-first to enjoy the efficiencies of recurring revenue.

Make investments in change management and technical training.

Follow the trends in the public-sector through the blogs and events of Tyler.

Roadmap & Future Outlook

The future of clients and stakeholders.

Deep Dive: 2025 R&D investment projection is estimated to be 193-198M.

Tyler is oriented to the next stages of analytics, computer-driving automation, and cloud-native ecosystems. The digital infrastructure of the public sector is anticipated to be stable long-term due to the ongoing SaaS momentum of the company and its migration roadmap.

Visual Assets Carousel

1 thought on “Tyler Technologies: Transforming Public Sector in 2025”